When Using an Aging Method for Estimating Uncollectible Accounts:

Definition of Aging Method. The majority of company leaders employ either a percent of sales or aging method.

Solved When Using An Aging Method For Estimating Chegg Com

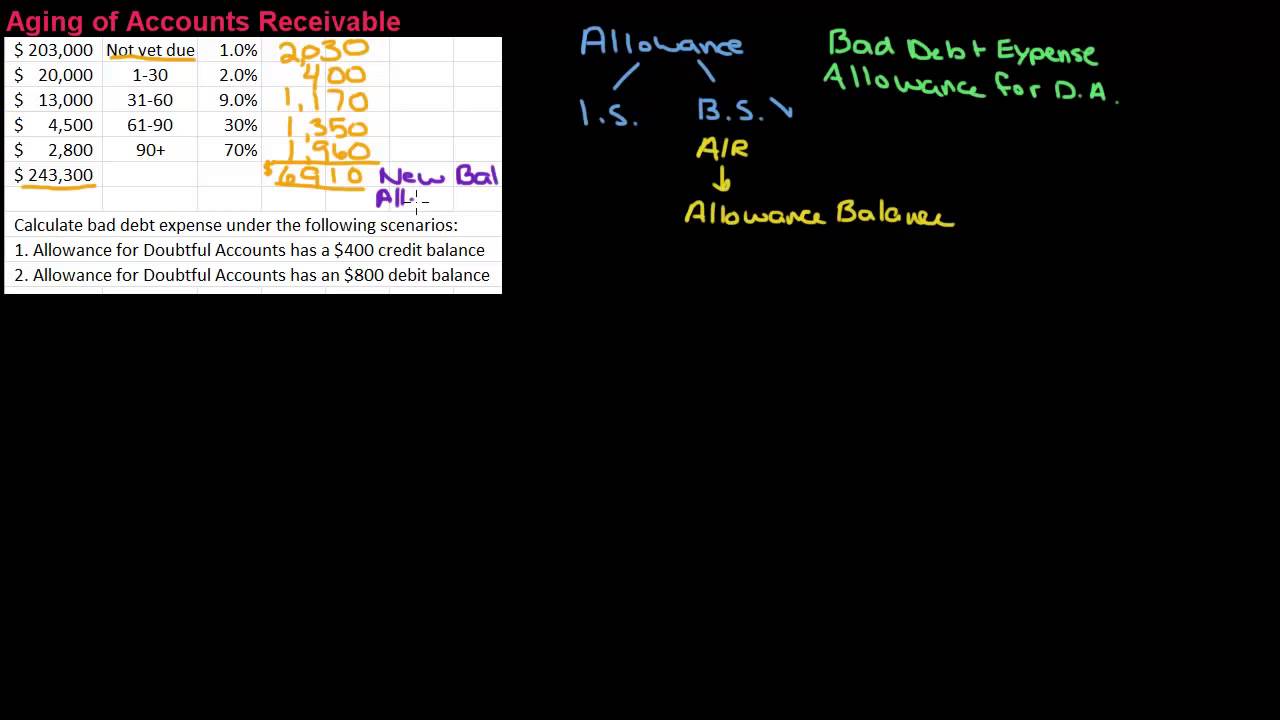

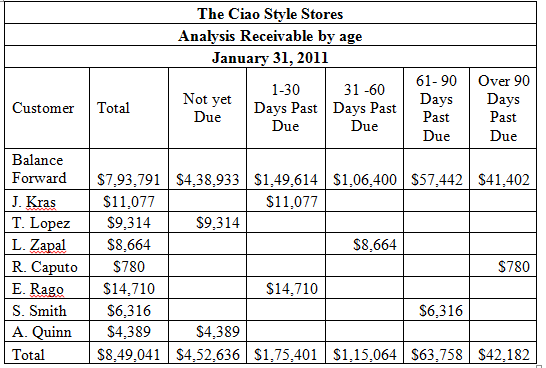

An aging of accounts receivable stratifies receivables according to how long they have been outstanding.

. Estimates that 8000 of its accounts receivable will be uncollectible. The first one is known as aging method or balance sheet approach and the second one is known as sales method or income statement approach. Prior to adjustment the Allowance for Uncollectible Accounts has a debit balance of 2000.

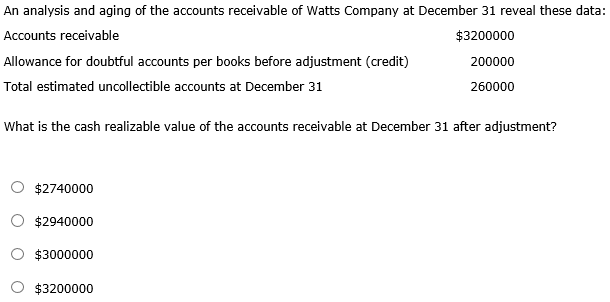

In the Allowance for Uncollectible Accounts. Estimating uncollectible accounts Accountants use two basic methods to estimate uncollectible accounts for a period. The debit balance in Accounts Receivable minus the credit balance in.

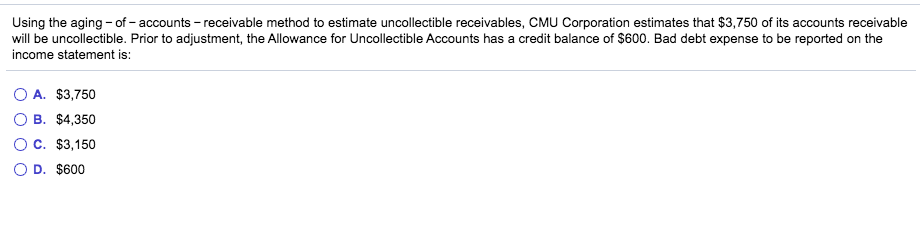

Prior to adjustment the Allowance for Doubtful Accounts has a credit balance of 600. The best way may depend on your particular business model. The estimated amount that will not be collected should be the credit balance in the contra asset account Allowance for Doubtful Accounts.

Percentages based on past history are applied to different strata. Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. It is likely based on past experience but it is only an estimate.

Bad debt expense to be reported on the income statement is. 11 Using the Aging Method for estimating uncollectible accounts if the total accounts receivable that is 61-120 days past due is 200000 and the estimated percent uncollectible is 40 what is the estimated amount uncollectible. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a 550 creditc.

Using the aging method to estimate uncollectible accounts is more accurate than applying a single percentage to all accounts receivable. Since the aging schedule approach is an. Estimate the balance of the Allowance for Doubtful Accounts using the aging of accounts receivable methodb.

B Utilize a percentage of probable uncollectible accounts for each age group of accounts receivable. D B and C. Instead the 25500 simply relates to the balance as a whole.

Estimating uncollectible accounts. 27 Using the aging - of - accounts - receivable method to estimate uncollectible receivables CMU Corporation estimates that 3750 of its accounts receivable will be uncollectible. There are two general approaches to estimate uncollectible accounts expense.

Using the aging of accounts receivable method to estimate uncollectibles Ute Mountain Company estimates that 8000 of its accounts receivable will be uncollectible. There are a variety of methods you can use to estimate these unpaid debts. Using the aging-of-accounts-receivable method to estimate uncollectible receivables Records Management Corp.

B focuses on the amount of receivables that will not be collected. Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. A results in an immediate write-off of receivables that are more than 90 days past due.

Allowance for Uncollectible Accounts has a credit balance of 1500. Using the percentage of net sales method Uncollectible Accounts Expense would be debited for. Preparing an aging of accounts receivable to identify the potentially uncollectible accounts.

A Take into consideration the existing balance in the Allowance for Doubtful Accounts. The aging lists every customers balance and then sorts each customers balance according to the amount of time since the sales occurred. The first methodpercentage-of-sales methodfocuses on the income statement and the relationship of uncollectible accounts to sales.

What is the amount of uncollectible account expense to be reported on the income statement. The aging of the accounts receivable approach to. C uses a balance sheet approach.

The aging method recognizes that the longer. A 20000 b 61000 c 80000 d 120000. The technique is to sort receivables into time buckets usually of 30 days each and assign a progressively higher percentage of expected defaults to each time bucket.

The aging method is used to estimate the amount of uncollectible accounts receivable. The year-end adjustment would include a. Net sales for the year were 250000.

Timkin creates the following accounts receivable aging report at the end of the year. The aging method usually refers to the technique for estimating the amount of a companys accounts receivable that will not be collected. Prior to adjustment the Allowance for Uncollectible Accounts has a credit balance of 2000.

In the past 3 percent of net sales have proved uncollectible and an aging of accounts receivable resulted in an estimate of 10000 in uncollectible accounts receivable. Age Amount Estimated uncollectible Less than 30 days 6000 5 31-60 days 4000 10 61 days 2000 25 Prior to adjusting entries the Allowance for Uncollectible Accounts has a debit balance of 500. 128 The aging of the accounts receivable approach to estimating uncollectible accounts does not.

It could have been determined via an aging analysis. Use the aging method to estimate future uncollectible accounts. Under this method the uncollectible accounts expense is recognized on the basis of estimates.

Two common ways of estimating the amount of uncollectible receivables are. The aging-of-receivables method for estimating uncollectible accounts.

Aging Method For Estimating Uncollectible Accounts Youtube

Estimated Uncollectible Accounts Debit Or Credit Accounting Methods

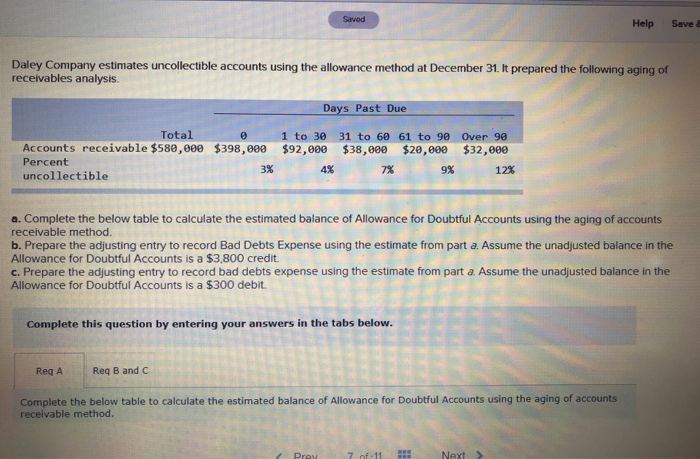

Daley Company Estimates Uncollectible Accounts Using Accounting Methods

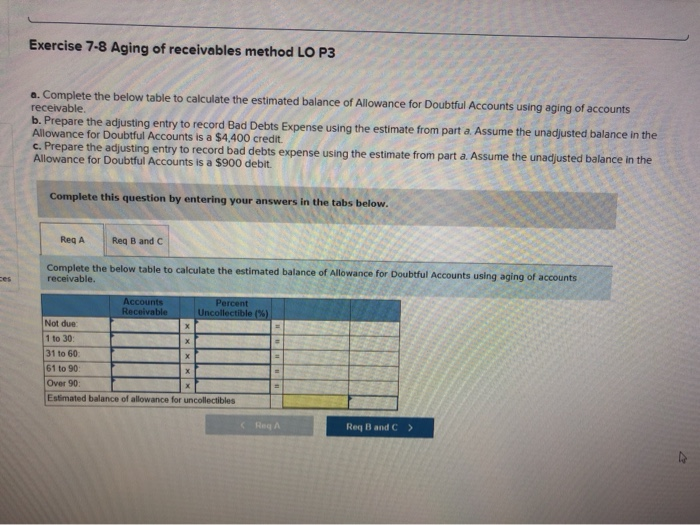

Estimated Uncollectible Accounts Per Aging Accounting Methods

Solved Using The Aging Of Accounts Receivable Method To Chegg Com

Solved Estimating Uncollectible Accounts And Reporting Accounts Receivable Course Hero

Estimated Uncollectible Accounts Per Aging Accounting Methods

Accounts Receivable And Uncollectible Accounts Ppt Video Online Download

Bad Debt Aging Of Accounts Receivable Method Youtube

Accounts Receivable Bad Debt Expense Using Aging Schedule For Uncollectible Accounts Youtube

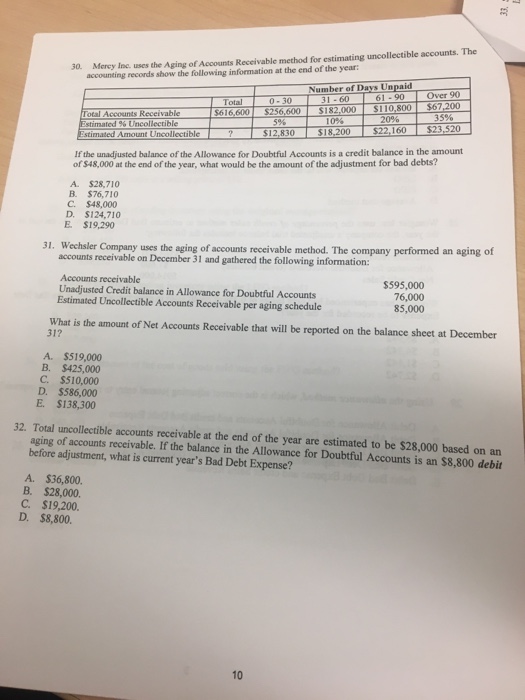

Solved Mercy Inc Uses The Aging Of Accounts Receivable Chegg Com

Aging Method For Estimating Uncollectible Accounts Youtube

Allowance Method For Uncollectible Accounts Course Hero

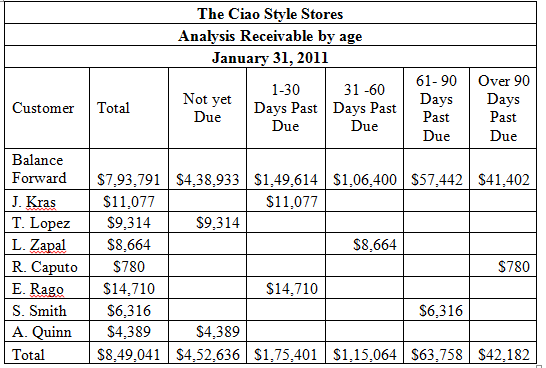

Solved The Ciao Style Store Uses The Accounts Receivable Aging Me Chegg Com

Chapter 7 Ch7 1 The Past Five Years A Company Had Average Annual Credit Sales Of 320 000 And Studocu

Allowance For Doubtful Accounts Aging Schedule Youtube

Allowance Method For Uncollectible Accounts Double Entry Bookkeeping

Solved Mercy Inc Uses The Aging Of Accounts Receivable Chegg Com

Comments

Post a Comment